Top Guidelines Of Top 30 Forex Brokers

Table of Contents9 Easy Facts About Top 30 Forex Brokers DescribedTop 30 Forex Brokers Can Be Fun For EveryoneThe Of Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For AnyoneThe Top 30 Forex Brokers StatementsThe Only Guide to Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For EveryoneSome Of Top 30 Forex Brokers

Each bar graph stands for one day of trading and has the opening rate, highest possible rate, lowest price, and shutting cost (OHLC) for a trade. A dash on the left represents the day's opening price, and a similar one on the right stands for the closing cost.Bar charts for money trading help investors determine whether it is a customer's or seller's market. The top portion of a candle light is used for the opening cost and highest rate point of a money, while the reduced part shows the closing cost and lowest cost point.

9 Easy Facts About Top 30 Forex Brokers Shown

The developments and forms in candlestick graphes are utilized to determine market instructions and motion.

Financial institutions, brokers, and dealers in the foreign exchange markets allow a high amount of leverage, suggesting traders can control huge placements with relatively little money. Take advantage of in the variety of 50:1 is usual in forex, though even greater quantities of leverage are available from particular brokers. Nonetheless, leverage has to be utilized cautiously due to the fact that lots of unskilled investors have actually suffered significant losses using even more take advantage of than was necessary or sensible.

All About Top 30 Forex Brokers

A money trader requires to have a big-picture understanding of the economic climates of the numerous countries and their interconnectedness to grasp the principles that drive currency values. The decentralized nature of foreign exchange markets implies it is less regulated than other financial markets. The level and nature of regulation in foreign exchange markets depend upon the trading jurisdiction.

The volatility of a certain currency is a feature of multiple elements, such as the politics and economics of its country. Events like economic instability in the form of a payment default or imbalance in trading connections with another currency can result in substantial volatility.

Indicators on Top 30 Forex Brokers You Should Know

The Financial Conduct Authority (https://www.intensedebate.com/people/top30forexbs) (FCA) monitors and manages forex sell the UK. Money with high liquidity have a ready market and show smooth and predictable price activity in feedback page to exterior events. The united state dollar is one of the most traded currency in the globe. It is paired up in six of the market's 7 most liquid currency pairs.

What Does Top 30 Forex Brokers Mean?

In today's details superhighway the Forex market is no longer exclusively for the institutional capitalist. The last 10 years have seen a boost in non-institutional traders accessing the Foreign exchange market and the advantages it offers. Trading systems such as Meta, Quotes Meta, Trader have actually been created specifically for the private investor and educational material has become quicker available.

Top 30 Forex Brokers for Beginners

Fx trading (foreign exchange trading) is a worldwide market for acquiring and offering money. At $6. 6 trillion, it is 25 times bigger than all the world's stock exchange. Forex trading dictates the currency exchange rate for all flexible-rate money. Therefore, rates alter frequently for the currencies that Americans are probably to utilize.

All money professions are carried out in sets. When you sell your currency, you receive the repayment in a different money. Every tourist that has actually obtained international money has done forex trading. For example, when you go on holiday to Europe, you trade dollars for euros at the going rate. You offer U.S.

The Definitive Guide for Top 30 Forex Brokers

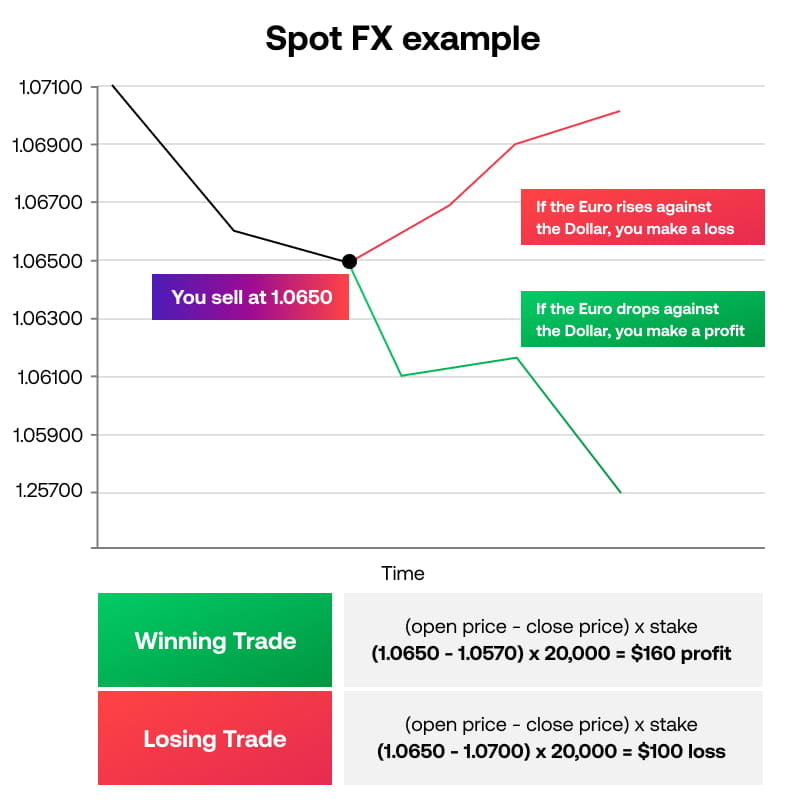

Spot purchases resemble trading money for a trip abroad. Spots are agreements between the trader and the marketplace manufacturer, or dealership. The trader acquires a certain money at the buy price from the marketplace maker and sells a various currency at the asking price. The buy rate is somewhat more than the market price.

This is the purchase expense to the investor, which in turn is the earnings made by the market maker. You paid this spread without realizing it when you traded your dollars for international money. You would see it if you made the transaction, terminated your trip, and after that attempted to exchange the currency back to bucks as soon as possible.

Getting The Top 30 Forex Brokers To Work

You do this when you believe the money's value will fall in the future. If the currency rises in value, you have to purchase it from the dealership at that cost.